Nuwave Rate Update - 10.11.22

Last week, the labor market print was released and showed unemployment dropping to 3.5%, an unexpectedly low number. This is not good news for mortgage rates.

As Shawn Cruz, head trading strategist at TD Ameritrade summarized:

“The market has been in a ‘bad-news-is-good-news’ mentality and there’s really no bad news in this report. It’s a solid jobs report, but it’s not what the market wants to see because it doesn’t give the Fed a reason to pause or shift away from its hawkish intentions.”

In the most recent FED meeting, Powell stressed the need to soften the labor market. This is clearly not happening. The FED's goal is to cool wage growth and inflation - the only way they can accomplish this is to continue with aggressive rate hikes.

Previously, the expectation was for the FED to raise rates fifty bps in their meeting Nov 1. With this unexpectedly low unemployment print, the FED will have no other option than to aggressively raise rates once again.

I would expect another 75 bps interest rate hike in the Nov 1 meeting.

The only reason this would not happen is if there is evidence of inflation falling in the CPI print that is released Thursday - Oct 13th. However, if Thursday's print supports the unemployment numbers, prepare for a 75 bps hike.

I am expecting the rate hike to be priced into the mortgage market starting as early as Thursday and continued through October preparing for the November FED meeting. I would not be surprised to see par rate (no points) to hover around 7.5% by the end of October.

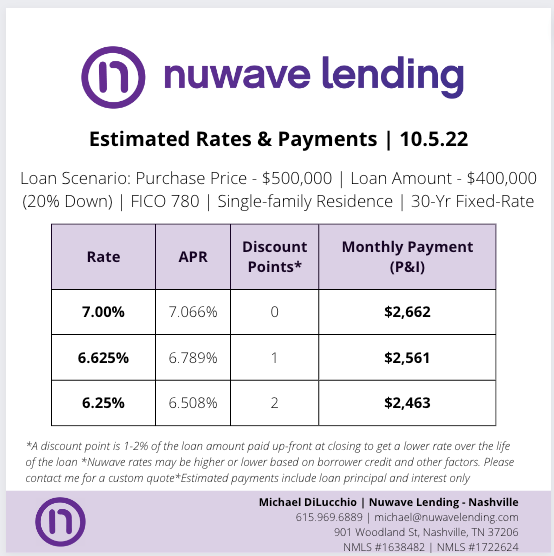

As I said in my previous post on Discount Points - prepare borrowers to either ask for seller concessions to cover discount points or set money aside to pay for those, more than likely they will be required to be paid at closing.

If you are a real estate professional and want a deeper dive into mortgage products, interest rate expectations, and how macroeconomics is affecting the housing market, check out our podcast - The Lender Soapbox - anywhere you listen to podcasts.