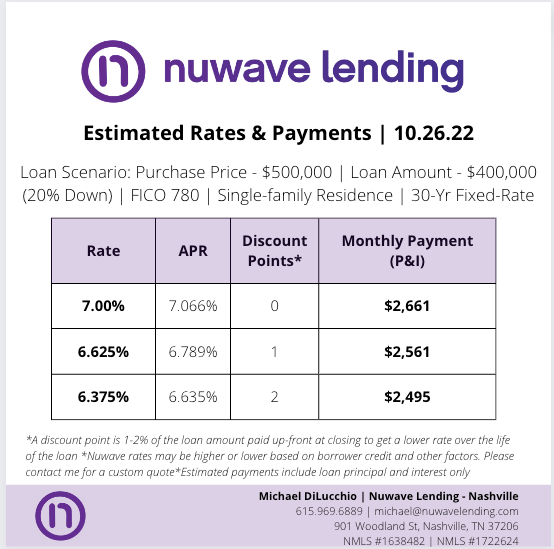

Nuwave Rate Update 10.26

This week, we started to see the first favorable signs in the interest rates and secondary market.

First, with Q3 earnings being released from the major tech companies, we saw the stock market elevated. While this is not a direct correlation to the interest rates (it more closely following the 10Yr T-Bill), we did see rates come down throughout the week.

Additionally, Chief Economics Correspondent at the WSJ, Nick Timiraos, published an article noting that "a change in FED policy may be in progress". Timiraos is considered by many to be a "FED whisperer" - correctly forecasting both FED rate hikes and reduction in QE back in 2021.

This pivot will not occur at the Nov 1st meeting, that is still expected by everyone to be a 75bps rate hike (already priced into the market).

However, the pivot may come in the December 15th FED meeting. Previous forecasts were expecting another 75bps, but that expectation has since been reduced to 50bps.

This indicates that the FED may begin to slow down the rate at which they raise rates. Giving the economy enough time to digest the rate hikes that occurred throughout Q3 and Q4.

Time will tell which direction the FED decides to go. For your borrowers over the next few weeks, I expect rates to rise slightly - most likely back to last weeks levels - before stabilizing prior to Nov 1.

If you have buyers who may be putting in offers this week, I would highly encourage them to do so. That way, you lock in this slight rate dip.

Cheers :)