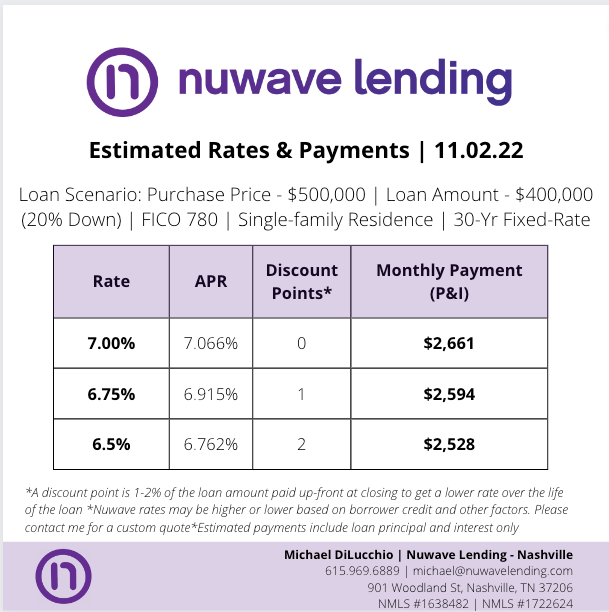

Nuwave Rate Update - 11.2.22

This week, we saw rates stay relatively steady in preparation of the FED meeting this afternoon. We saw only a slight uptick (.125%) in rates as of this morning, but the market has been stable for the last 7-10 days.

In the FED meeting this afternoon, there should be no surprises as the FED raises interest rates by 75 bps.

However, all eyes will be on Jerome Powell's press conference after the meeting. Specifically, market participants will be questioning the FED Chairmen's stance on the deceleration of the rate hikes.

There is much debate among experts whether rates will be hiked 75bps or 50bps during the meeting in December. If Powell indicates that these hikes may begin to slow down, it is an indication that the FED is planning on pivoting moving into Q1 2023. This could be good news for both the stock market and mortgage interest rate.

While it is almost inevitable that rates will rise through November, the press conference today could be the first glimpses of the light at the end of the tunnel.

As I have been saying for the last month or so, if you have buyers interested in this market, I would highly recommend moving on something sooner rather than later. We will surely see higher interest rates through the rest of Q4 and into Q1 of '23. Yes, prices may come down on the home sales, but it with further increases in rate, it may become an unaffordable monthly payment, even with a reduction in prices.

We will cover our immediate reactions to the FED's comments in - Ep 7 of The Lender Soapbox which will be released to you all tomorrow!

Cheers,