Nuwave Rate Update - 12.7.22

Over the last 25 days, interest rates have dropped a full 1%. To say this was a needed relief is quite an understatement.

This week, the FED is having their annual blackout period prior to their Dec 13-14th meeting.

Most likely, the FED will be raising rates by 50 bps next week. For the first time in several months, they are slowing the growth of the rate hikes to see how the new interest rates are digested in the economy.

While setting expectations with your borrowers, you can expect rates to stay consistent through the end of the week and into early next week. We will most likely see a marginal rise in rates following the FED meeting mid-next week.

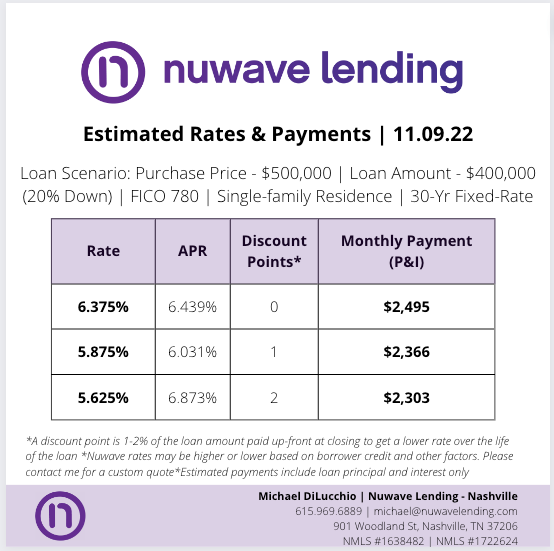

For borrowers that may be out looking, now is a better time than we have seen in the last 6 months to get under contract on a home. Anecdotally, I am seeing large seller concessions and price cuts on contract coming in. If you have borrowers looking to save cash, or buy down the rate, the negotiating power is favoring the brave.

As we move into the naturally slower holiday season, it would also be a great time for clients who want to buy in Q1 '23 to start putting together a budget and getting preapproved so they can hit the ground running in the new year.

Personally, I was excited to address the good news we have been seeing in the market. Now is the time to move on something.

If I have not spoken to you, I hope you have a wonderful holiday season and please let me know if there is anything Nuwave can do to help you and your clients :).

Cheers