Nuwave Rate Update - 2.15.23

What's the number one thing that markets hate? Uncertainty. That's exactly what was delivered in the CPI print this week.

CPI rose 0.5% in January (up from .1% in December)

Jason Furman (Harvard Univerity) states in a Brookings discussion:

Looking at the last three months, a more meaningful time frame, core inflation (that is excluding volatile food and energy prices) grew at a 4.6% annualized rate, faster than the three-month reading in the last report.

“Those annual rates aren’t really getting any better, and they’re very far from what the Fed would like to see, and far frankly from what we thought they were going to be a month ago,”

This report has left it unclear if the FED has contained inflation. It is for this reason that you are seeing interest rates rip upwards throughout the week.

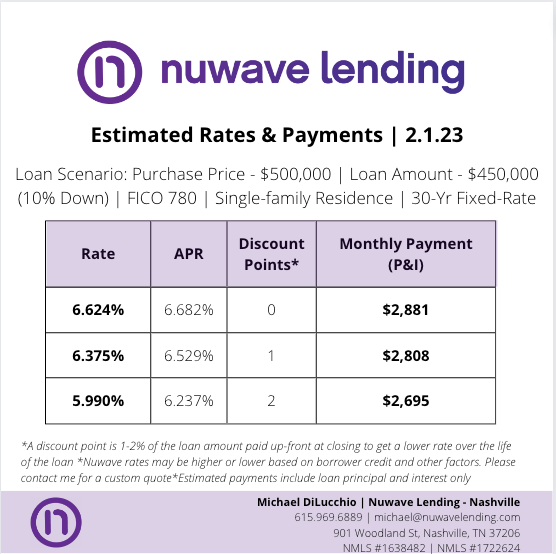

Anecdotally, I have seen the facuet of leads and applications turn off as soon as rates jump above 6.5%. It feels like that is the threshold that people are willing to borrow mortgages at. As we saw over the last 30 days, when rates drop below that threshold, there is a flood into the market.

As the uncertainty continues in the secondary market, expect rates to remain higher for longer.

On the other side of the coin, as buyers exit the market, the ability to get seller concessions becomes increasingly possible. If buyers are willing to take the higher payments, they could be rewarded for it.

Sources: