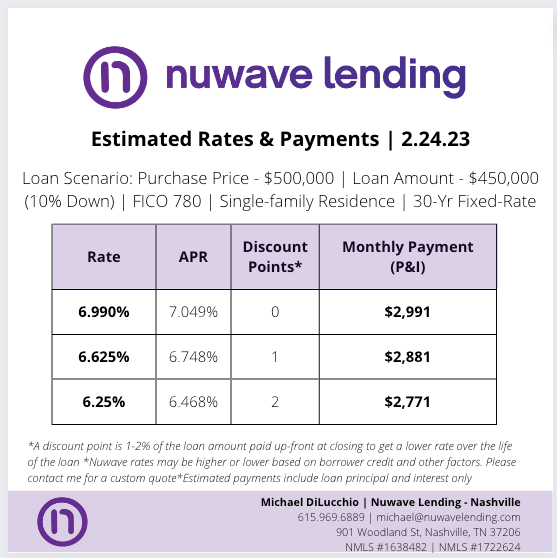

Nuwave Rate Update - 2.24.22

What happened?

This is the question I am getting from real estate agent partners, potential buyers and sellers, and prospects I have talked to over the last three weeks.

The market has seen the floor fall out from under it.

Today, the main driver is PCE (personal consumption expenditure) which is a measure of the prices that people in the US pay for goods and services. This is one of the FEDs favorite metic to measure inflation. This PCE jumped .6%, the largest rise since last summer. This figure had started to fall at the end of 2022, which is why we started to see a decrease in interest rates.

"In other words, what this means is the Fed is not done, further pressure on yields to push higher, the battle against inflation has not yet won, and volatility for the stock market."

For now, I would reset expectations with your potential buyers. Interest rates may stay higher than we think for longer than we think.

As we make the turn into March, the chance of positive news could come from the Mar 14th CPI print or Job reports coming next week.

But only time will tell...

Soruces: