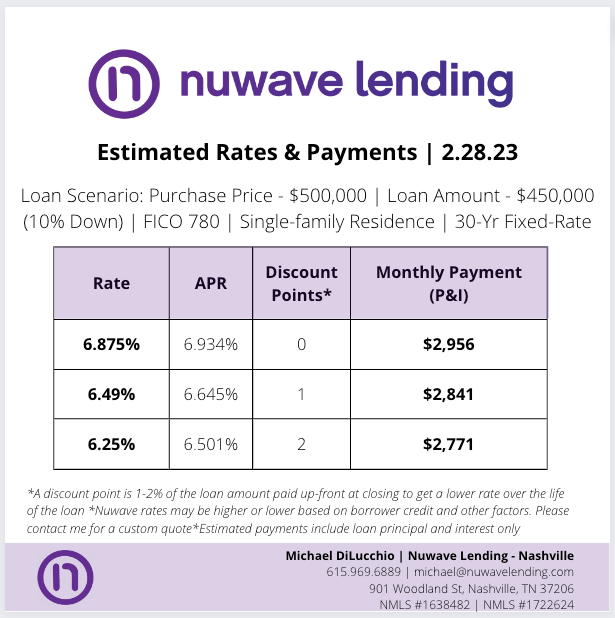

Nuwave Rate Update - 2.28.23

Today, we saw the first brief reprieve in mortgage rates since early last week. It feels like these rates are skipping along for the bottom of the pool currently.

With no key market indicators being released this week, I would expect little to no movement until next week.

As I said in the previous update, if you have clients looking to purchase something over the next 30-45 days, I would highly suggest resetting expectations with them. Their monthly payment will be higher than they were previously expected.

On a positive note - here are some key dates to highlight on your calendars. These markers should be indicators for when we may start seeing a decrease in rates.

Mar 10th - Feb Jobs Report

For many analysts, there is reason to believe the January jobs report have several lagging indicators which resulted in overestimating the actual status of jobs in the US. If this print results in falling employment, we should see some decrease in mortgage rates.

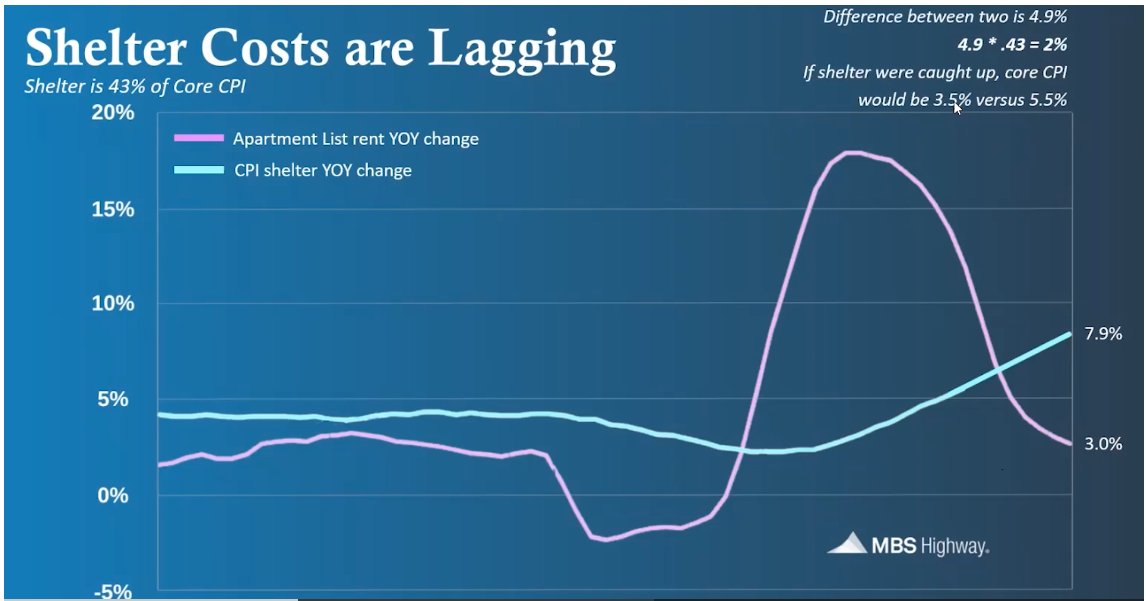

Mar 14th - CPI Print - Inflation Numbers

The key metric to keep an eye on here is Shelter Costs. This makes up 43% of the CPI print (that's a lot). According to an Apartment List rent report - Year-over-year rents have increased 3% (down from 17% YOY Change last summer).

If you look at the chart below, this shows the CPI prints alongside the actual rent reports. In summary, these are extremely lagging indicators. It will take a couple of months for the CPI Shelter YOY to accurately reflect the rent changes we are seeing on the ground. As we move into the summer, expect that blue line to meet up with the purple one.

See Note at the top right - if shelter were caught up CPI would be 2% lower than what it is actually being printed at. That means a huge improvement in rates is coming.

May 5th - turnaround point projection (April CPI Print)

Here is where I believe rates will turnaround. This is the date of the April CPI Print.

To be clear, I am not saying I think rates will be at 4% in May. I am saying in May, we will start seeing this ship turnaround. I think as we move into the early summer, we could see rates start to drop below 6% and even creep near 5% if the trends we are seeing in the market today, continue.

For now - here is where we stand. For those buyers agents out there - ask for the moon in concessions. See my previous instagram post (@mfdilucchio) if you need to know the max you can ask for :)