Nuwave Rate Update 9.22.22

Well, folks there you have it...the FED met yesterday and raised interest rates 75bps. That was not surprising to anyone.

The more surprising comments came following that announcement. Jerome Powell indicated that the FED intended to continue increasing interest rates until the end of the year. That means, rates could increase another 145-150 bps before the year rolls to 2023. That is an enormous swing in a single year.

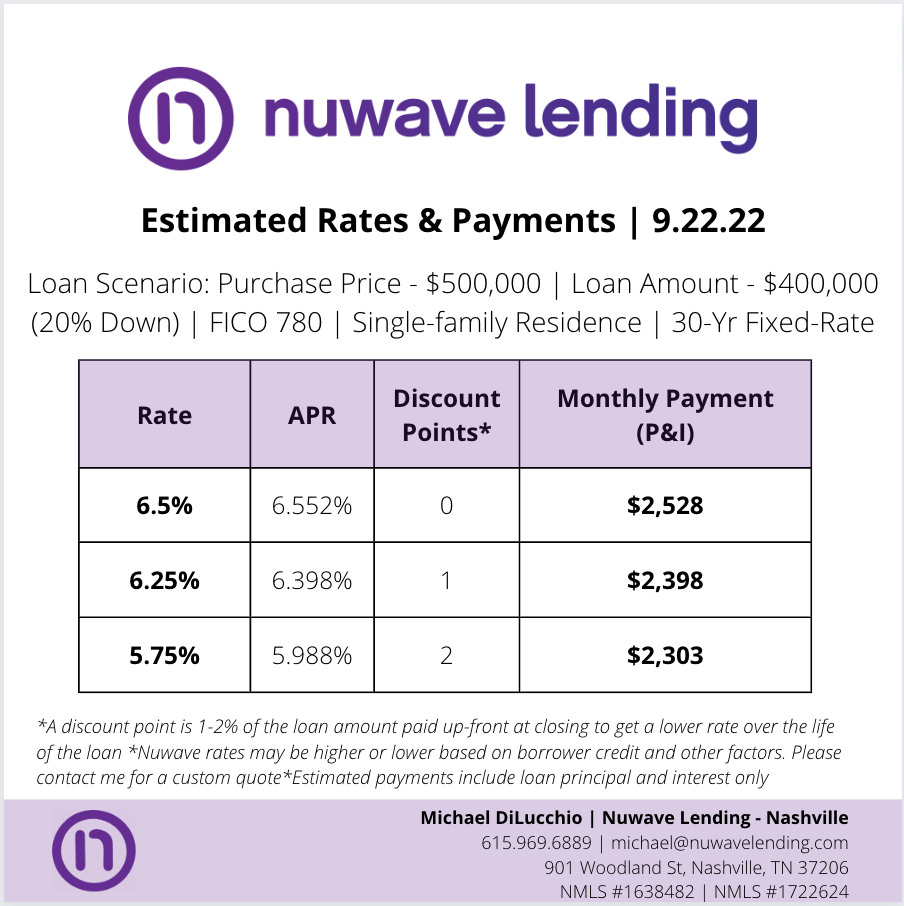

Below are the updated rates for today. As I said previously, the 75bps increase was expected and, therefore, already priced into the mortgage market. That is why we did not see a drastic swing in rates overnight.

However, as we continue into October, I would expect rates to keep climbing. Personally, I believe rates will be over 7% by the end of the year, and possibly around 7.5% before things level out. For borrowers in the market, it would be advantageous to purchase something sooner rather than later if they are in the market.

If you want to hear more about the macroeconomic environment, housing data, and implications of these hikes moving forward, check out our podcast - The Lender Soapbox - anywhere you listen to podcasts :) Give it a follow and share this blog post and podcast with your teams!!