Nuwave Rate Update - 9.30

September really decided to disappear on us. Here is our month-end rate update.

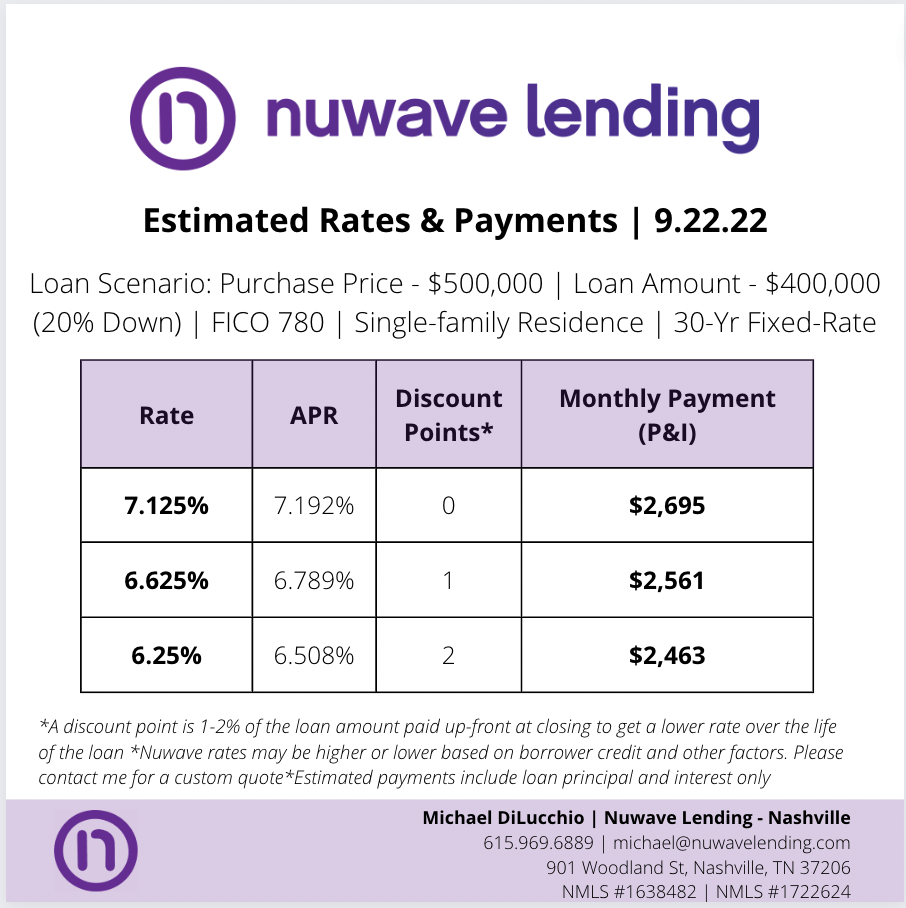

TLDR - Par rate has risen to 7.125% in the last week. FED 50 bps rate hike should be priced in throughout October. If CPI Print (Oct 13th) is worse than expected, that hike could be more severe

Since our last update (9.22) rates have jumped more than 50 bps. As I mentioned in my previous blog post, discount points will continue to be recommended to buyers, if not required.

Throughout this month, I have continued to advise clients to use the seller buy-down method in lieu of offering below list. "Discount Points" continue to buy down the rate about .5% which is extremely beneficial considering the decrease in monthly payment...especially if you can get someone else to pay for it.

As we enter a market of increased supply, the leverage buyers have will continue to grow. For buyers, I would advise to ask for large seller concessions to not only buy down the rate, but also to cover closing costs on the mortgage.

Note for agents - seller concessions can only cover closing costs, prepaid items (escrow account), and discount points. Seller concessions cannot cover any of the down payment. Be sure to double check with your lender to ensure the client is not wasting any of the seller concessions.

As we move into October, I expect rates to continue to rise, but at a much slower pace than the market saw in September. The next FED meeting is Nov 1 and market experts predict another 50 bps rate hike.

The September CPI print will be released Oct 13th. If the market sees higher-than-anticipated inflation numbers, we could see a higher rate hike. But, until the print, expectations will remain at 50bps.

Cheers to October.

If you like this content, please share with your team, clients, and friends. You can subscribe for free at the top right. I will never spam you. Please share as we continue to grow :)