The $11.1 Trillion Market you Aren't Marketing To:

Reverse mortgages.

Before you roll your eyes, get a pit in your stomach, or brush me off as a predatory lender, read this article - in full.

I will breakdown what these loans are, who qualifies for them, why someone would want to do this, the main drawbacks of the loan, and finally go through some scenarios so you can see practical examples of this loan.

Reverse mortgages or HECMs (Home-Equity Conversion Mortgage) are the opposite of a traditional mortgages. Instead of making monthly payments on the loan and paying down the principal over time, the borrower’s loan balance increases over the life of the loan and they make no payment as long as they live in the property.

That's right - they have a $0 monthly mortgage payment.

To qualify for this program, the borrower (or both borrowers) must be over the age of 62. There are no credit score or income requirements.

These loans can be used to purchase a new home, refinance an existing loan, cash out the equity of a property, or set up a line of credit on the home's equity.

In the US today. Homeowners over the age of 62 own a total of $11.1 Trillion in equity.

The first obvious question - why would someone who lives in a completely paid off (or mostly paid off) home ever move?

A recent poll of the Baby Boomer generation asked a simple question - "What is the number one reason you are moving?" My first inclination was that it was to move to a senior living facility, downsizing, or decreasing overall expenses - it wasn't any of these.

The answer was simple - the generation wants to move closer to their grandchildren.

The problem emerges for these buyers when the desire to move towards their grandchildren clashes with the affordability of purchasing a new home.

These buyers don't care about maximizing the return on their house or leaving the maximum amount of inheritance possible. They care about seeing the people that they love for the time they have left on earth. This is where a HECM can be the best option - see scenario #1 for a further explanation on this point.

With a reverse mortgage, a borrower in this situation can purchase a new home near their grandchildren while still not having a mortgage payment. In many cases, they will also have additional funds to put away in savings for living expenses or future emergencies.

Before we get into the detailed scenarios, I am sure you are asking - "this all sounds great, but what is the catch?"

The main drawback is the cost of the loan. Unlike traditional mortgages, these loans require both an Up-front Mortgage Insurance Premium (UFMIP) and monthly mortgage insurance paid for through the equity of the home.

The Up-front Premium is 2% of the appraised value of the home. The annual mortgage insurance is .5% of the loan amount. These costs are added to the principal balance of the loan throughout the term.

The second drawback is the depletion of the equity in the home. Overtime, as the loan balance grows, the owner has less equity in the home. When the borrower either passes away or moves out of the home, the mortgage must be paid off in full through the sale of the property or paid off in cash.

Note - if the loan balance at the time of repayment is higher than the proceeds from the sale of the property, the difference is forgiven and guaranteed to the bank by the FHA (this is funded through the MI payments made). The heirs are not required to pay the difference.

Scenario #1 - Grandparents want to move closer to their grandchildren

Let's say a couple owns a $400,000 house in Chicago that is completely paid off. They are wanting to relocate to Nashville to be closer to their family. After the sale of the Chicago home, they have about $372,000 (after realtor fees, closing costs, etc.)

As many of you know, it is becoming increasingly difficult to purchase a home in the greater Nashville area for less than $400k. Especially if they are trying to live close to their grandchildren in an area like metro-Nashville where the median sales price was 448k last month (Sep 2022).

This scenario, traditionally, leaves these borrowers with two options:

- Move further out from downtown and purchase a home for ~370k in cash.

- Purchase a home closer to the family and take on a mortgage payment

The first option is obviously not ideal. The point of moving was to be closer to grandchildren. As the buyers gets older, they probably wont want to sit in traffic for 45min each way to see the family.

The second option is also not great. Not only will this increase their monthly expenses, these borrowers may not even qualify for the mortgage they need! To qualify, they will need to have enough retirement income coming in from pensions, social security, etc. to cover the DTI requirements for a traditional mortgage. That could be substantial with the addition of a new mortgage payment.

This is where a reverse mortgage could be the best option for them.

A buyer can actually use a reverse mortgage to purchase a new home and put ~50% down (down payment requirements depend on age of borrower and current interest rate).

In this scenario, the borrowers can take their profits from previous sale and go buy a 500k - 700k home in Nashville with no monthly payment.

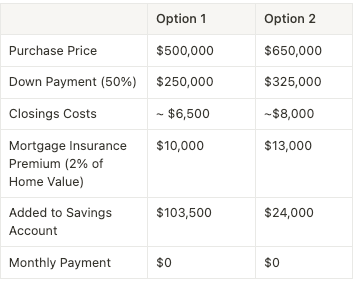

Let's look at it visually:

Proceeds from Sale of Chicago home - $370,000

The reverse mortgages has three benefits in this scenario:

1. Allows the borrowers to continue having no mortgage payment on their home. This keeps their monthly expenses the same, if not lower.

2. Allows the borrowers to move closer to their grandchildren. They can be in a much closer and safer neighborhood/home when they have the purchasing power at 500-650k rather than 350-370k.

3. Allows the borrowers to put additional money away in their savings so that they continue living their life.

Scenario #2 - Borrower's need additional savings, but do not want to move from their home

Reverse mortgages do not have to be used in a purchase of a home, you can also refinance with a reverse mortgage.

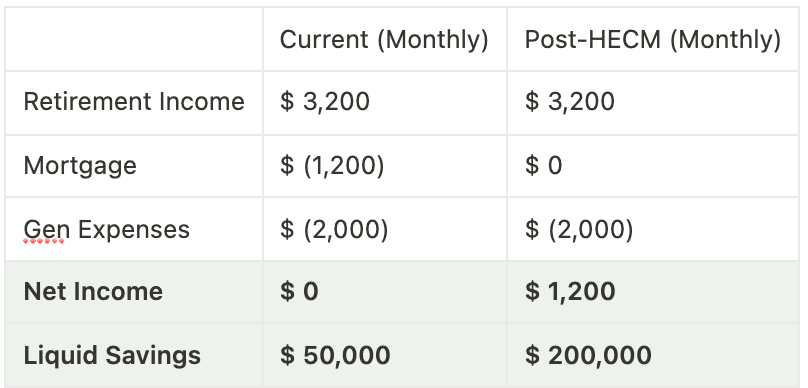

Let's say an older couple lives in a home on their own. Their house is worth $500,000 and they owe $100k on the property with a mortgage payment of $1,200.

Together, they receive $2,500 in Social Security benefits and $700 from a pension monthly. Currently, they have 50k in their retirement/savings account remaining.

This couple knows that the majority of their net worth (as is the case with most Americans) is held in their home's equity. However, this couple does not want to move from their family home. They are worried that they are going to run out of savings in the next few years and be forced to move.

Here is another example where a reverse mortgage makes the most sense for them.

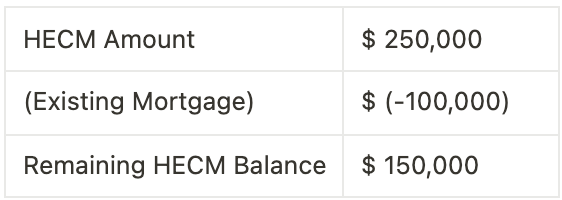

This couple can set up a HECM (Home-Equity Conversion Mortgage) that is set up as a line-of-credit (similar to a HELOC) instead of a lump-sum payment for 50% of the home's equity. In this case, $250k.

[With a HECM, you only accrue interest on money that you have drawn from the credit line. If you do not take out any of the funds, you do not accrue any interest.]

With a HECM, this couple can pay off the remaining $100k on the property, removing their mortgage payment entirely. On top of that, they have an additional $150k credit line they can use for any household expenses, large medical expenses, or general living expenses for the entire time they live in their home.

Here is their new household expenses:

With the HECM the borrower's get the following benefits:

- They do not have to move out of their house

- They have an additional 150k in savings for emergency & life expenses

- They have $1,200 less in monthly expenses

These are just two examples of how a reverse mortgage can help your clients, or your client's parents.

As I said previously, I do not think this loan is for everyone. But this can be a godsend for some borrowers. If you think your client may benefit from a reverse mortgage, please have them reach out and I would be happy to go over their specific situation.

If you want to her an in-depth conversation on this topic - check out Ep 6 of The Lender Soapbox -

https://open.spotify.com/episode/0dWERegO2wHWG9n5ppvfte?si=c5acabb3826e4845

Cheers :)