The Break-Even Calculation

Rates are up over 6%, inventory has risen to the highest levels since pre-pandemic, mortgage applications are down 57% year-over-year. Welcome to the new normal.

As I have written about previously, a great way to combat these high interest rates for new buyers is by "buying-down" the rate with discount points. The best way to do this is to have the seller pay for it (see more here - Seller "Buy-Down")

But, how can someone determine how many discount points is enough? Should a buyer just continue to purchase discount points to lower the rate?

A good way to visualize how many discount points are right for you is a calculation called the "Break-even point". The break-even point is the point in time where the sum of savings on your monthly payment surpass the money it cost to buy the rate down.

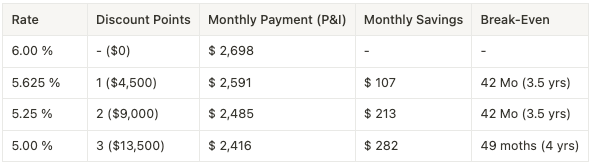

Look at this example below:

This borrower is buying a home for $500,000 and putting 10% down (loan amount $450,000)

If this borrower bought one point, it would take them 42 months (3.5 yrs) to make their money back on the $4,500 additional costs they paid for at closing. Looking at line two, the break-even point is exactly the same if the borrower were to pay two points. Lastly, if the borrower pays for three points, they will breakeven at the four-year mark.

This is merely a way to visualize the benefits of these discount points. Realtors and lenders should be discussing with buyers the actual benefits of these discount points.

Yes, discount points get buyers a lower rate, but buyers can't frame the interest rate on their wall at home. They need to look at the practicality of putting up the additional funds at closing.

Have your buyers think about where they may be in 3.5-4 years. That is Q4 of 2026. Are they planning on still being in the house? Moving jobs? Having a family? Selling the home at any point? Are they expecting to refinance their rate in the next few years?

If they don't see themselves holding on the house for longer than the break-even point, they will never see the true benefits of the lower rate. They would be better off having the slightly higher payment.

This is assuming, of course, they are the ones paying the point.

In a best case scenario, which we are seeing more of in this market, buyers can ask the seller to pay for these discount points for them. In the example above, if a buyer can get seller concessions for $4,500, then the first discount point is free and the buyers get the benefits from day one. The break-even point is exactly zero months because it cost you nothing to get the lower rate.

If you want to go through this calculation with your buyer you can do the following:

1 Point = (Purchase Price - Down Payment) * .01 [2 points is the same but .02]

Break-Even Point (months) = [1 point] / (Payment at original rate - payment at buy down rate)