Nuwave Rate Update - 2.13

Just when I thought things were going to settle down...the market continued its extreme volatility.

Rates over the past week have jumped over 30 basis points. The main driver of this is two fold.

First, the FED raised interest rates by 25 bps, as many of you know. In their meeting, they also indicated an additional 25 bp hike in late Mar. The market is most likely pricing this in now - although my expectations was that this wouldn't happen until early March.

Secondly, Fannie and Freddie released an announcement regarding LLPAs (Loan-level pricing adjustments) that will negatively impact some borrowers moving forward.

LLPAs are the engine that drives how mortgage rates are priced. LLPAs are why an interest rate is better if you have a higher down payment or higher FICO. All of this is based on the LLPA on the file

These LLPAs are changing this year. The borrowers impacted the most are clients with mid-range credit (740-760) and putting down 5-10%. Their rates are being impacted heavily for the worse.

As we move closer to May, it will become increasingly important to get with experienced loan officers who know these LLPAs and how to get your clients the best deal. They can assist with increasing credit scores, adjusting down payments, decreasing DTI, etc that can help drop the interest rates.

Overall, I expect this week to be more volatile than I initally exepcted. I would not be surprised if we saw rates drop through the middle of the week and increase back up to 6.5-6.625% by the end of the week.

The good news is that this should cool the market off slightly. As rates dropped below 6% two weeks ago, we saw mass entry into the market. I saw, almost overnight, multiple offers, overask, and similar deals from the white hot market. If you have buyers, the increases in rates may benefit them by allowing for seller concessions or discounts again, as we saw in December/early-Jan.

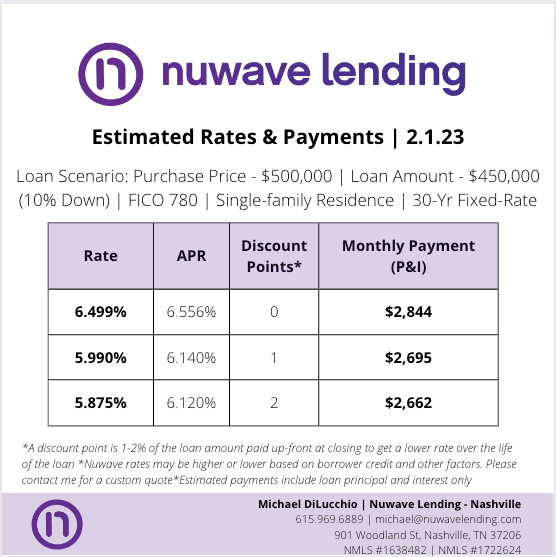

Lastly, paying one discount point is becoming increasingly more cost effective. The first discount point today drops the rate by almost .5%. If you have clients considering this option, it is more beneficial than ever to buy down the rate.