"2/1 Buy-down" For Your Buyers - Explained

As interest rates continue to rise, buyers are finding it harder to afford the mortgage payments on homes they are interested in purchasing. We are seeing buyers purchase "points", opt into adjustable-rate mortgages (ARMs), or even delaying a purchase for the foreseeable future.

Another tool to consider using for your clients is called a "2/1 Buy-down".

Simply put, this option gives a buyer a discounted mortgage payment for the first two years of the term. The interest rate and mortgage payments are reduced as the result of a lump sum of money deposited into a "buy-down account" by the seller.

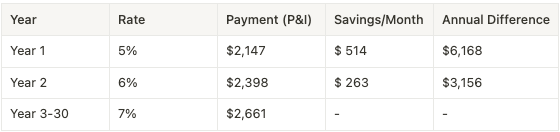

In the first year mortgage, the mortgage payment is calculated as [Note Rate - 2%]. In the second year, the payment is calculated as [Note Rate - 1%]. Then, in Years 3-30, the payment is calculated as normal.

Let's look at an example:

This client is purchasing a home for $500,000 with 20% down and 780 FICO. Today, the 30 yr fixed note rate is 7%.

The sum of the "annual difference" in monthly payments is covered by seller concessions, deposited into a "buy-down account" (similar to an escrow account). This is to ensure the mortgage company is paid their full interest over the life of the loan.

If you are an agent putting in this offer, you would need to request $9,324 in seller concessions to fund the "buy-down account". This is very similar to asking for two discount points from the seller.

2/1 Buy-down vs Discount Points

I am sure you are asking yourself - why choose this option over traditional discount points?

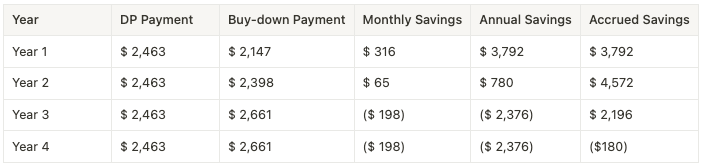

Let's compare the same example above to having the seller pay two discount points on the loan:

On the two discount points (DP) option, you could buy down the rate to about 6.25% for the same cost as the "2/1 buy-down" option.

As you can see above, the buyer sees significant benefits on the mortgage payment in years 1 & 2 - saving a total of $4,572. Then, from years 3 and beyond, the buyer begins losing money on their deal each year compared to buying discount points.

So, what's the difference? - in the "2/1 Buy-down" option, you are front-loading your savings in years 1 & 2. Whereas, in the permanent discount points option, you are spreading your savings out over the life of the loan.

If you look at my previous post on Discount Points, you will see that it can take 3-5 years before a client sees the benefits of the discount points. If the client thinks rates will come down in the next year or two and they will refinance, or if they plan on not even being in the home for more than 4 years, the "2/1 Buy-down" option is actually better for them. It is allowing them to maximize their savings in the first two years of their loan term.

The main drawback of this option is clear - the payment will increase overtime. My advice has been consistent throughout this market and can be reiterated in the blog post on "Dating the Rate" - if the client is not comfortable with the final payment at the 7% rate, do not choose this option. There are situations that occur in a client's life outside of their control that can prevent them from refinancing. If they are not ok with the final payment, I do not advise this route.

Hopefully this can act as another tool in your tool belt for buyers and investors who are comfortable with a little more risk. This option can help buyers save a ton of money in the first few years of the mortgage and can help relieve the shock we have seen in mortgage payment increases over the last few months.

As always if you have additional questions or need further explanation, you can reach me at 615.969.6889 or michael@nuwavelending.com

Cheers.