Should You Trust, "Marry the House, Date the Rate"?

One of the most popular trends real estate professionals on TikTok and Instagram are saying is "Marry the House, Date the Rate." This is terrible advice.

One of the most popular trends real estate professionals on TikTok and Instagram are saying is "Marry the House, Date the Rate."

The basic concept is to encourage buyers to ignore the interest rates in the market and look at the home instead. It has an underlying assumption that rates are going to go down and you will be able to refinance in the future for a lower monthly payment.

This is terrible advice.

The real estate market is not a silo.

If rates plummet, it means the country is in the middle of a recession and the FED is trying to spark economic growth. If the country goes into a recession, property values will start to come down, people will start to be laid off, and investment/retirement accounts will start to decrease in value. All of these things can greatly affect a homeowners ability to refinance at all, even if rates do go back down to 3%.

Let's look at an example - the market crashes, rates plummet, but you cannot refinance:

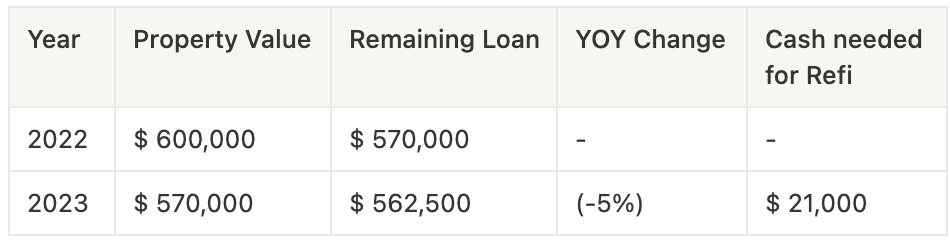

This borrower bought their home for 600k with a 5% down payment. Due to market conditions, property values have dropped a modest (-5%):

In this scenario, the homeowner has been "dating the rate" and is ready to break up with it for the hot, new 3.5% rate. But, the market has shifted. Their home has dropped a little in value because the market has cooled. Not huge deal...unless they are trying to refinance.

To do a rate & term refinance, the max LTV is 95% based on the new appraised value. That means in order to get the new rate this homeowner would need to pay an additional $21,000 out of pocket to close a refinance.

Think about the real market conditions in the middle of recession - people are getting laid off, businesses are struggling, there could even be wars on the horizon.

Are homeowners going to want to take 21k out of their savings account and put it into an illiquid asset they just saw decrease in value?

Agents don't want to hear the harsh truth - if the buyer is not comfortable with the monthly payment where rates are today or it appears to be stretching their budget, they should do one of the following:

- Look for a cheaper house

- Ask the seller to buy-down the rate for them

Buyers are not dating their rate. They cannot break up with it whenever they want and there are market conditions out of their control that can affect refinancing.

"Dating the Rate" is not a real estate strategy nor is it advice professionals should be telling prospective buyers. It has an underlying assumption that interest rates will certainly go down, which is a horrible assumption to put onto uninformed buyers.